If the interpretation that inflation was caused mainly by supply constraints is correct, then that suggests that as this multitude of supply factors sort themselves out - and many already have, from autos to some building materials to airfares - the U.S. A reasonable conclusion, therefore, is that as of early 2020, strong demand had at best a very modest effect on inflation, as long as supply conditions were normal. But we enjoyed similarly strong demand in late 2019, before the pandemic: the unemployment rate - a simple but fairly accurate indicator of demand strength - at that time was about 3.5 percent, yet the Fed’s challenge then was to raise stubbornly low inflation to its 2 percent target.

An alternative explanation is that the primary culprit behind elevated inflation is an excess of aggregate demand due to a recovered economy spurred in part by generous government support during the COVID pandemic.The main factors raising inflation may well have been transitory, but a cavalcade of global disruptions, including the war in Ukraine and more recent COVID responses in China, have caused more persistent increases in inflation. 2021 had been at or above 5 percent for six months. By late-2021, the notion that inflation would ease within months was dubious - inflation by Dec. But “transitory” inflation turned out to be longer-lived than many expected. In the first half of 2021 many people thought that inflation would come down fairly quickly with the easing of these constraints. Most agree that COVID shutdowns led to transitory supply constraints.These more recent readings probably better reflect the current underlying rate of inflation. Inflation over the past 3 to 6 months has declined to somewhere between 2.5 and 4.5 percent (at an annual rate), depending on the month (see chart above). The twelve-month inflation rates compare current prices to those from one year ago and are thus arguably too backward-looking. It has since retreated to about 6 percent ( 5 percent for the Fed’s preferred inflation measure, the personal consumption expenditures chain-type price index, or PCE) – lower, but still well above the Fed’s target rate of 2 percent.

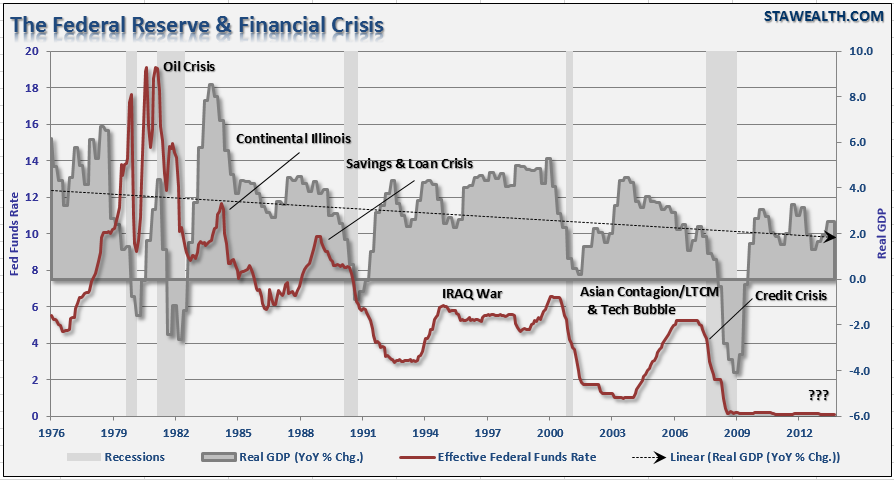

Inflation over the past 12 months, as measured by the CPI, was more than 9 percent in the summer of 2022 – the highest rate since 1981.

Former EVP and Director of Research, Federal Reserve Bank of Boston The Issue:

0 kommentar(er)

0 kommentar(er)